March 2024 Market Update

The Spring Housing Season is Upon Us

What’s Hot / What’s Not in Greater Phoenix

For Buyers:

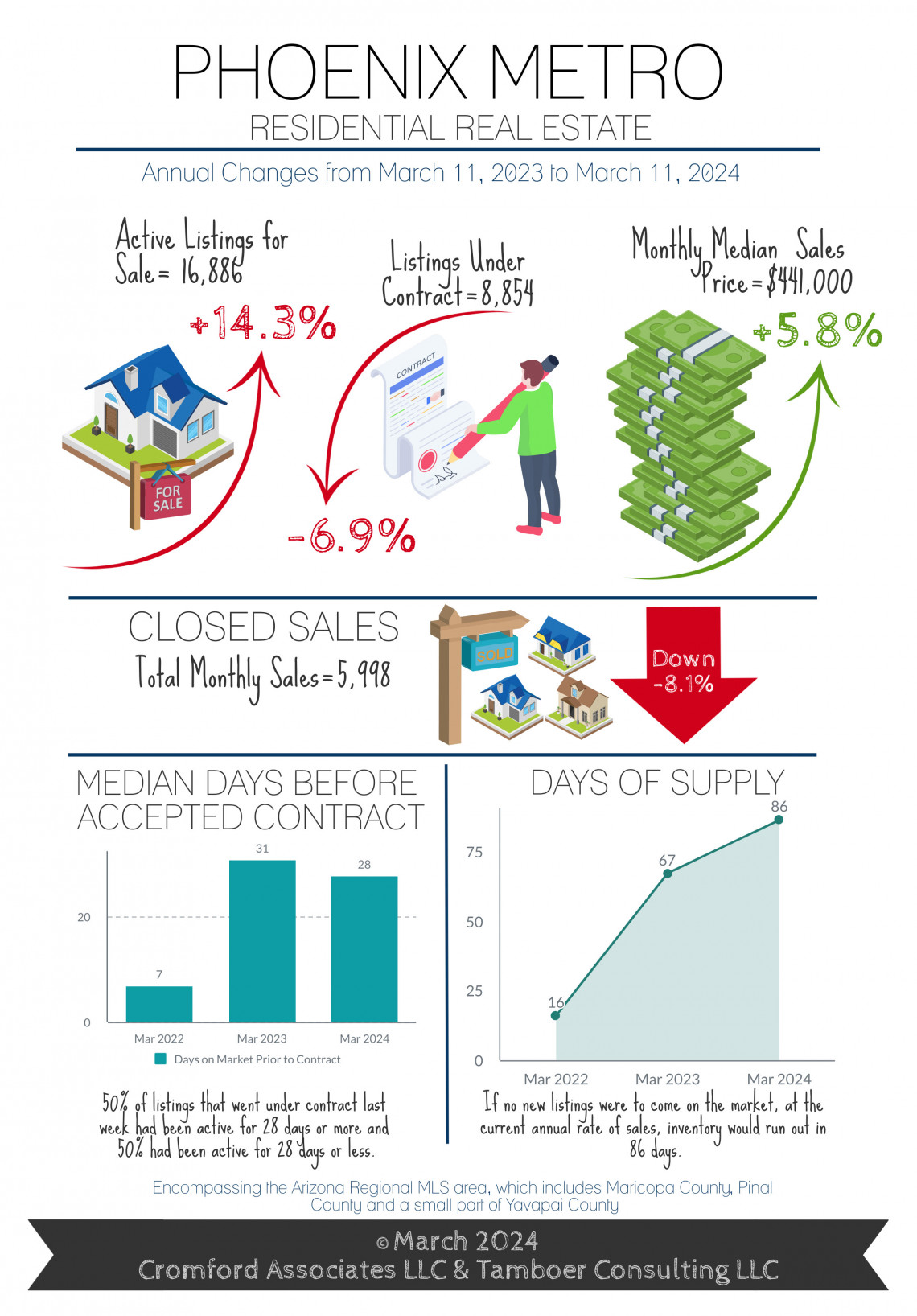

Spring is peak home buying season in Greater Phoenix. March is the 2nd most popular month for new listings historically (January is #1), and the beginning of a 4-month long closing season that lasts until June. Supply is up 14% over last year, still 31% below normal, but 16,886 active listings feel like an avalanche compared to 2 years ago when there were only 4,400 to choose from.

Higher mortgage rates continue to keep buyer competition lower than normal, but even mild declines in the rate have resulted in a boost in weekly accepted contracts. Closings over asking price have edged up seasonally to 17% of March sales so far, but the majority of sales are negotiated down by an average of 2.1% below list pice.

Builders have been ramping up new single family home permits over the past 7 months, up 32% since June 2023. Over the last 3 months, 73% of new home sales closed have involved builder incentives paid to the buyer, with at least 50% paying $11,500 or more. These incentives typically go towards buying down the mortgage rate and saving the buyer $100’s on their monthly payments.

Those who have been keeping these updates over the past year have probably noticed that the median sales price has barely moved for 10 months. Starting at $440,000 from June-July 2023, stagnating at $435,000 from September-December, dropping to $430,000 from January-February 2024, and now back up to $441,000 in March. While the current appreciation rate from last March measures +5.8%, over the next 2 months this will start to move closer to 3%, which is in line with the rate of inflation.

This 10-month stagnation in price, which has endured erratic mortgage rates ranging from 7-8%, has allowed some breathing room for annual incomes to catch up to prices. While low affordability rates are leading negative headlines this month, they are largely based on 2021 median family income from the U.S. Census, which doesn’t reflect the influx of higher paying jobs, inbound migration fueled by the “work from home movement”, and private sector income growth experienced in Greater Phoenix in 2022 and 2023. Updated income reports combined with an expected mild decline in rates this year provide a reasonable expectation that affordability is set to improve. In short, don’t listen to affordability reports that say the majority of homes are not affordable to the masses. You only need to find the one home that’s affordable to you. Don’t give up.

For Sellers:

Spring is statistically the best time to be a seller in Greater Phoenix as buyer activity closes in on its seasonal peak from April through May before slowing down from June through December. This season some areas and price points have been heating up more than others compared to last year, but heat is not all about demand because it’s difficult to increase sales without supply for sale.

For example, areas with the highest percentage increase in contracts over the past 2 months happen to be on the edges of the Valley, such as Black Canyon City, Carefree/Cave Creek, Rio Verde, Sun Lakes, Wittmann, El Mirage, and Avondale. However, with the exception of Avondale, none of these areas feel particularly hot to active sellers because there’s more competing inventory to accommodate the increase in demand.

When supply is taken into account, the hottest areas of Greater Phoenix where supply isn’t quite sufficient for Spring demand gravitate to the south. Namely Avondale, Tolleson, South Phoenix, Ahwatukee, Chandler, Gilbert, and San Tan Valley. While median prices in these areas are still flat, reasonably priced sellers are selling 1-2 weeks faster than the current 4-week median time frame.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2024 Cromford Associates LLC and Tamboer Consulting LLC

Thinking about selling?

Our custom reports include accurate and up to date market information.

Thinking about buying?

Everyone deserves to love where they live.

.png)

.png)

.png)

.png)